CIBIL Score is a three-digit number that ranges between 300 and 900. It shows your credit history, i.e. how well you paid your previous loans and credit cards. This score is created by Credit Information Bureau India Limited (CIBIL). If you want to take a loan, banks first check your CIBIL score. The better the score, the easier it is to get a loan!

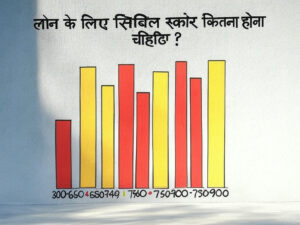

How much CIBIL score is required for a loan?

Each bank has its own criteria, but generally the following CIBIL score ranges are considered:

- 750-900: Very good score. You will get loan easily and the interest will also be low.

- 700-749: Good score. Most banks will give you a loan, but some may also look at your income.

- 650-699: Average score. Getting a loan may be a little difficult and the interest rate may be high.

- Less than 650: Low score. Chances of getting a loan are low.

A score above 700 is considered safe for a home loan, personal loan or car loan.

What is CIBIL Score?

- Loan approval: Banks consider you trustworthy if you have a good score.

- Low interest: If you have a high score then you get a cheaper loan.

- Higher amount: If you have a good score, you can avail a loan of a higher amount.

How to improve CIBIL score?

If your score is low, don’t panic. You can improve it with these simple tips:

- Pay bills on time: Never make credit card and EMI payments late.

- Reduce debt utilization: Do not use more than 30-40% of your credit limit.

- Do not ask for loan repeatedly: Applying more than necessary spoils the score.

- Check Report: View your report from CIBIL website and get the errors rectified.

How to check CIBIL Score?

You can check your score for free by visiting the official website of CIBIL. This facility is available for free once a year. Apart from this, many banks and apps also provide this service.

conclusion

CIBIL score is a mirror of your financial health. Try to have a score of at least 700 to get a loan. If you pay bills on time and use the loan properly, your score will automatically improve. So pay attention to your credit history today and be loan ready!